Guide on Paying International Vendors - China Vision

- Date:

- Author: SVI Content Team

- Share:

In today’s connected world, global trade flows faster than ever. China, as one of the leading manufacturing hubs, has long been a destination for foreign companies sourcing products.

For companies working with Chinese suppliers, one of the biggest concerns is choosing the best way to pay overseas suppliers safely and effectively.

In this blog, we’ll present to you the most common payment methods used when paying international vendors in China. You will get a clear overview of each option and learn the process of how to pay international vendors step by step. Without further ado, let’s see what methods there are.

Part 1. Things to Consider Before Paying International Vendors

It’s important to ensure your suppliers are trustworthy before sending payments across borders. This helps you determine the payment method and guarantees that both sides build a successful and satisfying partnership.

Take the following factors for consideration:

- Have you reviewed the supplier’s company profile or conducted a factory audit?

- Are you working with a new supplier or an established long-term partner?

- What’s your order size (samples or bulk production)?

- Are you okay with making advance payments?

- How quickly does the payment need to be processed?

- Whether suppliers provide inspection reports for the payment request?

- What are the transaction fees and foreign exchange rates?

- Is there proper payment proof & documentation for disputes or customs clearance?

Part 2. Best Ways to Pay Overseas Suppliers

Method 1. International Wire Transfer (T/T – Telegraphic Transfer)

Telegraphic Transfer (T/T) is a wire transfer of funds from one bank account to another. It’s one of the most popular payment methods in international trade and is settled in foreign currency.

The buyer entrusts a bank in the country where they are located to pay the funds to the payee in some way.

At the application of the remitter, the remitting bank shall send a Tested Cable or SWIFT to the branch in another country or the receiving bank to instruct it to release a specific amount to the recipient.

Payment Terms:

The payment can be divided into several terms:

- Full payment upfront: 100% T/T in advance;

The buyer pays the full amount via bank transfer before shipment. This term favors the seller by securing payment early.

- Part-payment terms: T/T Deposit + Balance;

A common structure is 30% paid in advance and 70% before shipment or against a copy of the bill of lading (B/L). This term favors the buyer by reducing upfront risk.

Flow:

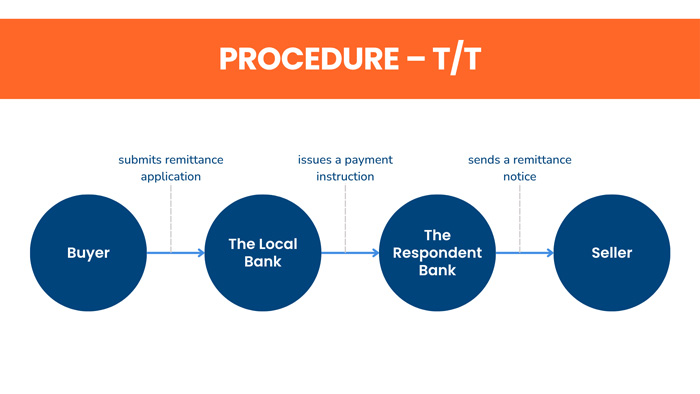

- Buyer → submits remittance application to the local bank

- The local bank → issues a payment instruction to the respondent bank

- The respondent bank → sends a remittance notice to seller

- Seller → confirms receipt

Required Information:

- The beneficiary: name, address, contact number, and payment amount

- The respondent bank: the bank name, address, bank account number and identifier (SWIFT code)

Processing Fees: a small percentage of the transfer amount

Speed: fast and could achieve instant transfer.

- Local T/T – within 1 to 2 business days;

- International T/T – within 2 to 5 business days.

Suitable for: Wire transfers are used more frequently in transactions with repeat buyers or long-term partners, as well as in small or medium transactions.

✅ Pros

- Fast delivery

- Widely accepted

- Simple process

- Lower bank fees

❌ Cons

- Sensitive to exchange rates

- Rely on commercial credit

Method 2. Letter of Credit (L/C)

L/C is currently the most important and commonly used payment method in global trade. It is a conditional payment commitment by a bank.

It is a written guarantee document issued by the buyer’s bank to the beneficiary at the request and instruction of the applicant for the letter of credit.

As long as the beneficiary submits documents (a B/L, invoice, and packing list) in accordance with the agreed conditions outlined in the L/C within a certain period and the stipulated amount, the beneficiary will receive the payment.

Through L/C, the buyer can transfer the credit risk to the bank, and the seller can also ensure payment after submitting documents that meet the requirements of the letter of credit.

Payment Terms:

- Sight L/C: The beneficiary gets paid immediately after the required documents are presented and approved by the bank.

- Usance L/C: The seller gets paid after a set number of days after the bank’s acceptance of the documents. It is usually 30, 60, or 90 days after sight.

- Irrevocable L/C: It cannot be changed or canceled by the issuing bank unless all parties involved (buyer, seller, and issuing bank) agree to the amendment or cancellation.

- Revocable L/C: It can be changed or canceled by the issuing bank at any time, without notice to or consent from the beneficiary (seller).

Flow:

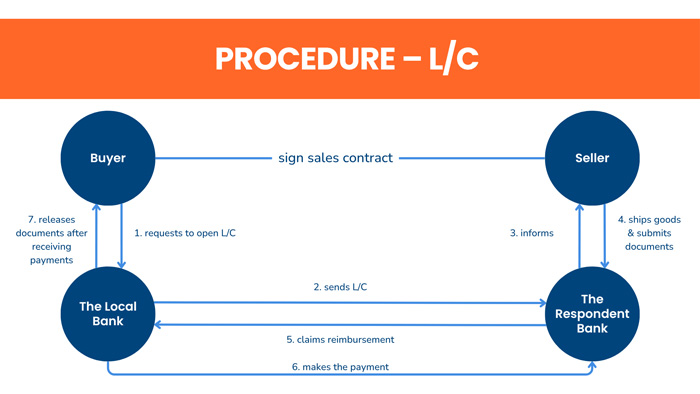

- Buyer & seller → sign sales contract & agree to use L/C

- Buyer → requests the issuing bank to open L/C

- The issuing bank → sends L/C to advising bank

- The advising bank → verifies authenticity and advises the beneficiary

- Seller → ships goods & submits related documents to the advising bank

- The advising bank → checks, forwards documents, and claims reimbursement

- The issuing bank → reviews & approves documents

- Payment → is released to the advising bank, and seller → gets paid

- Buyer → pays the issuing bank for the documents

Required Information:

- L/C agreement terms and number

- Buyer (applicant): name and address, issuing bank information

- Seller (beneficiary): name and address, advising bank information

- The total amount and currency of the L/C

- Expiry date and location of the L/C

- Shipping terms and product description

- Payment terms

- Shipment date and port of loading/destination

- List of documents the seller must present to the bank to get paid

Processing Fees: rates + fixed fees

Banks charge issuing fees and processing L/Cs (for buyer’s bank), and advising fees (for seller’s bank)

Speed: fast; usually 2 to 7 days, and can speed up once it gets the confirmation from the issuing bank

Suitable For:

- The first transaction

- Neither side fully trusts the other

- Large amounts

- A secure, document-based payment

✅ Pros

- One of the safest ways to pay Chinese suppliers

- Independent of trade contracts, seller gets paid if the terms are met

❌ Cons

- Higher bank fees

- More paperwork and strict compliance

- Time-consuming than T/T

Method 3. Documentary Collection

Documentary Collection is best for suppliers who wish to retain control of the goods before receiving payments or a formal promise to pay. It remains one of the most common payment methods.

After the exporter ships the goods, they need to instruct their bank to forward key commercial documents (i.e., B/L), shipping documents, along with the draft, to the bank in the imported country. The importer can only obtain these documents, and thus access the goods, after a payment or a commitment to pay.

Payment Terms:

Based on how and when payment is made, there are two main types of documentary collection:

- Documents against Acceptance (D/A): The importer receives the documents after agreeing in writing to pay by a specified future date.

- Document against Payment (D/P): The importer receives the documents only after making full payment. Based on payment times, it is divided into D/P at Sight and D/P after Sight.

Flow:

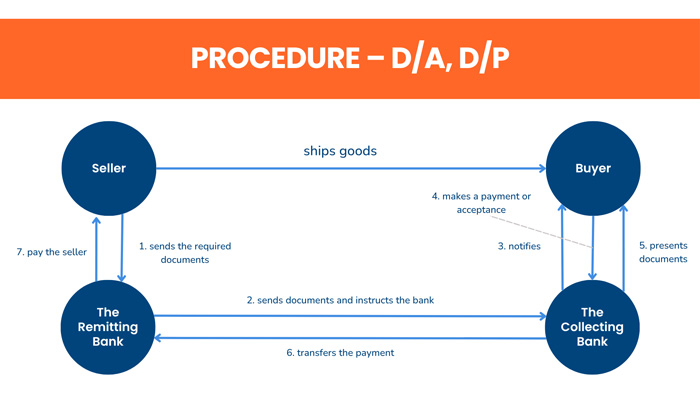

- Seller → ships goods, and sends the required documents to the bank with instructions

- The remitting bank → sends documents to buyer’s bank (the collecting bank).

- The collecting bank → notifies the buyer

- Buyer → makes a payment or acceptance

- The collecting bank → presents documents based on the terms, transfers money and informs the remitting bank

- The remitting bank → transfers payments to the seller

Required Information:

- Buyer: name and address, contact, and collecting bank information

- Seller: name and address, contact, and remitting bank information

- Shipping documents

- Sales contract

- Bill of Exchange (Draft): Instructions for the bank and release, payment amount, and payment terms

Processing Fees: rates + fixed fees

Suitable For:

- D/A – established and trusted partners, buyers who want to pick up goods before payment

- D/P – partnerships with moderate trust, or medium-sized transactions, sellers who want to retain more control

✅ Pros

- Flexible to choose to pay instantly or in the future

- More control for sellers

- Less expensive than L/C

❌ Cons

- No bank guarantee of payments

- Risks of buyers refusing to pay or accept documents

Method 4. Sourcing Agencies

For companies sourcing products through a sourcing agent, making payments to suppliers in China via the agent is another practical option.

Sourcing agencies usually include a one-stop solution for importers, from finding suppliers and managing shipments. The service may ease your workload and reduce potential risks as they negotiate the prices for your best deal and handle the process for you.

However, this method requires buyers to conduct proper due diligence and cooperate with agents who have already built established relationships.

SVI Global is one such trusted sourcing partner, offering end-to-end support for businesses looking to buy from China and beyond. With over 20 years of experience, you can believe us to optimize your process, making it transparent, efficient, and secure. With us backing you, you can focus on scaling your business.

Flow:

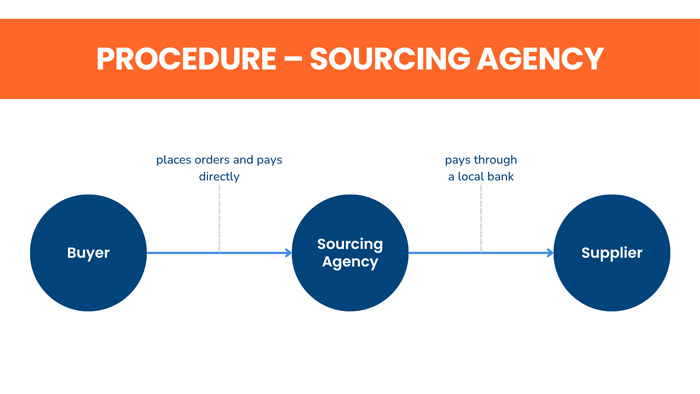

- Buyer → sources products through the sourcing company and pays the order to it, not the supplier directly

- Agency → receives the payment and pays suppliers in China through a local bank

Fee:

The service fee generally depends on your order value, quantity, and the level of support required.

Some sourcing agents may not include payment handling to Chinese suppliers in their standard service and could charge an additional fee.

So, always confirm whether the quoted fee includes all services to avoid hidden costs.

Speed: Depending on the payment term agreed upon by you and the agent

Suitable for:

- Buyers who aren’t fluent in Chinese

- Buyers who aren’t familiar with local trade rules

- Businesses wanting to outsource manufacturing to facilitate processes

✅ Pros

- More convenient

- Streamline the payments process

- Reduce the risks of fraud and product quality

❌ Cons

- Agencies may add additional fees for payment handling

- You will need to work with a trusted agency

- Less direct control

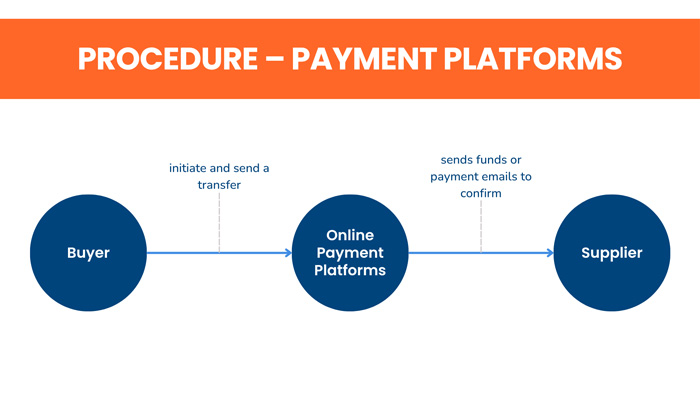

Method 5. Use Online Payment Platforms

To meet the demand for faster, simpler, and lower-cost payments, third-party online platforms like PayPal, Wise, and Payoneer emerged. In China, most suppliers support this method. These platforms help buyers pay international suppliers without going through a bank’s full process.

Most platforms cover the main countries across the world and support multi-currency transactions. They offer a convenient way to transfer money and avoid the red tape of in traditional way.

Flow:

- Buyer → signs up for an account, initiates and sends a transfer by entering the supplier’s details

- Seller → receives funds right after payment, or receives the payment email

Required Information:

- Supplier’s details – name, email, or contact number

- Bank name, address, and account number

The specific information required should be based on the actual needs of each platform.

Fees: A certain percentage of handling fee + service fee (suppliers pay for the fee – PayPal)

Speed: Usually instant or within minutes

Suitable for:

- Small orders or sample payments

- New supplier trial runs

- E-commerce sourcing

✅ Pros

- Fast processing

- Easy to use

- Traceable

- Widely accepted

❌ Cons

- Limited protection

- Exchange rate loss

- High fees for large payments

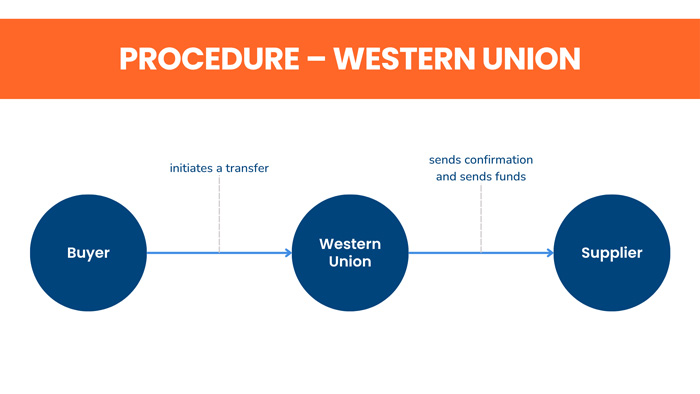

Method 6. Western Union

Western Union, with its extensive agency network and advanced technology, provides efficient and convenient small international remittance services to users worldwide in 200+ countries.

In China, it maintains close cooperative relationships with many well-known banks, such as China Everbright Bank, Postal Savings Bank of China, and China Construction Bank.

For small private remittance needs, Western Union is undoubtedly a preferred choice.

Flow:

- Buyer → initiates a transfer and enters the supplier’s payment info

- Seller → receives confirmation and chooses the way to receive money

Required Information: Name, country and city, payment method

If sending to a bank account, you’ll also need the bank name, account number, and SWIFT/BIC code.

Fees: Tiered pricing model – transfer fees vary by amount, destination, and payment method + currency exchange markups (buyers pay for the fee)

Speed: Available within minutes

Suitable for:

- Small amounts to individuals or small companies

- Emergency or fast cash transfers

✅ Pros

- Fast transfer speed

- Global coverage

- Easy to use

- Long brand history

❌ Cons

- Higher fees than online payment platforms

- Lower daily and per-transaction limits

- Not suitable for large formal payments

Conclusion

Before choosing the best way to pay overseas suppliers in China, you should take a moment to think over your situation, such as your business size, trust level with the supplier, minimum order quantity, and risk tolerance.

Each payment method offers different advantages for processing overseas business payments.

For example, T/T is straightforward, L/C provides strong security, online platforms are fast and flexible, and sourcing agencies offer hands-on support.

The key is to understand your options, communicate clearly with your suppliers, and select the method that best balances cost, speed, and security for your specific situation.

But for most businesses, wire transfer is the most widely used method. It’s fast, reliable, easy to use, and comes with relatively low fees, making it a popular and practical choice for international payments.