What Does FOB Price Mean in International Trade

- Date:

- Author: SVI Content Team

- Share:

As companies expand cross-border and international trades become diversified, trade terms are developed to help businesses better manage costs, risks and duties based on the general business practices.

Among the terms, FOB – Free On Board, is one of the most commonly used Incoterms in cross-border trade. It defines exactly what you and your supplier should pay for and handle up to a specific point.

As a person who engages in international business, you should be aware of the importance of FOB and understand what the FOB price includes and what it doesn’t.

In this blog, you will learn the definition of FOB, and know what the seller and buyer are each responsible for to ensure a smooth global transaction. Here we go.

Part 1. What Is FOB Price

What Does FOB Stand For in Shipping?

FOB stands for “Free On Board” or “Freight On Board“. It is an international Incoterms used in global trade and a shipping term of actual delivery on board ships at the export port.

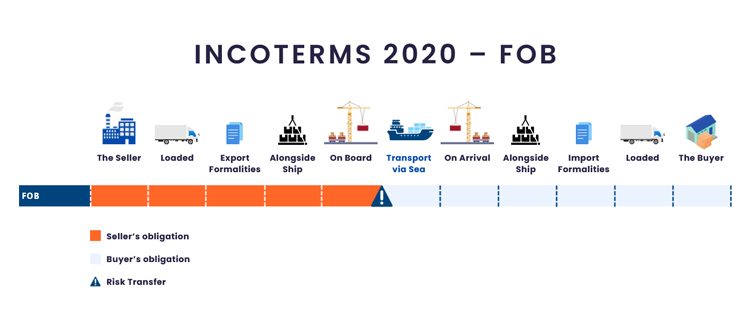

In the Incoterms 2020 Rules, FOB is used only for sea or inland waterway transport. It defines the point at which the responsibility and risk for goods transfer from the seller to the buyer during shipment.

The seller is responsible for everything up to the point of loading.

Once the goods are on board the ship at the agreed port of shipment, the buyer covers all costs and assumes liability for any damage or loss during ocean transport from that point forward.

Liability of Both Sides

✅ The Seller (Before Loading):

- Supply goods as per contract and provide the required proof of conformity.

- Deliver goods on board the vessel at the specified port and time.

- Obtain export licenses and complete all export-related formalities.

- Cover all costs and risks up to the point the goods cross the ship’s rail.

- Provide proper packing (unless goods are customarily shipped unpacked).

- Issue a clean document (e.g., bill of lading) proving goods were loaded.

- Provide the certificate of origin if the buyer requests it (at the buyer’s expense).

- Assist in obtaining other import-related documents (at the buyer’s cost and risk)

- Handle quality checks (e.g., weighing, measuring) required for delivery.

✅ The Buyer (After Loading):

- Arrange and pay for vessel space

- Assume all costs and risks once goods pass the ship’s rail at the port of shipment.

- Pay for the goods as agreed in the contract.

- Cover extra costs and risks of ocean/air freight, import customs declaration, import duties and inland transportation to the final destination.

- Pay for the bill of lading and any import-related documents (e.g., certificates of origin, consular docs).

What Does FOB Price Mean in Shipping Orders and Contracts?

When you request a quotation from a supplier, you may come across the term FOB price. As the term “FOB” in international trade, the seller takes responsibility before the goods are loaded.

Therefore, when a supplier quotes an FOB price, it means the cost of the goods includes all charges up to loading them onto the ship at the specified origin port.

For example, if a contract states “FOB Shenzhen Yantian,” the seller handles everything up to the point the goods are loaded onto a vessel in Shenzhen Yantian port. From that point forward, the buyer arranges and pays for shipping, insurance, and import clearance.

Part 2. What Does FOB Price Include

An FOB price reflects all the costs a seller must cover to deliver goods onto the ship at the port of export. Here’s what it typically includes:

✔ Product Cost

The agreed manufacturing or purchase cost of the goods you source overseas (in other countries).

✔ Packaging Cost

Standard packaging is required for safe transportation and handling, unless the goods are usually shipped unpackaged.

✔ Local Transport to Port of Departure

The cost of moving the goods from the factory to the port of departure.

✔ Loading Charges

Fees for handling and loading the goods onto the vessel at the origin port.

✔ Export Clearance

All customs paperwork, export duties, and other formalities are required to legally ship the goods out of the country.

Part 3. What Is Not Covered in FOB Price

Everything that happens after the goods are on the ship is the buyer’s responsibility. Here’s what is not included in the FOB price:

✔ International Sea Freight

The cost of shipping goods from the port of origin to the destination port.

✔ Shipping Insurance

Any insurance to cover damage or loss during ocean transport should be arranged and paid for by the buyer.

✔ Destination Port Charges

Unloading, terminal handling, and any port fees at the arrival port.

✔ Import Duties and Taxes at the Destination

All customs duties, VAT, and import-related costs in the buyer’s country.

✔ Inland Transportation at Destination

The cost of delivering goods from the port of arrival to the final location (warehouse, distribution center, etc.).

FAQ about FOB Prices

Q1. What are the advantages of FOB pricing for buyers?

1) Clarify the responsibility: The term sets a straightforward transfer point of each liability.

2) Ensure legal clarity: FOB is part of the globally recognized Incoterms. Its contractual and legal obligations are fairly well established under Incoterms and case law.

3) Break down costs clearly: The FOB pricing basically includes costs only up to loading the goods at the port. Its clear structure can let you calculate the expense more easily.

4) Gain flexibility in shipping: Buyers can choose their carriers and shipping routes, which gives great control over logistics and costs.

5) Balance risks and control: FOB shipping better splits the duties and risk to let sellers obligate up to loading and buyers manage things afterward.

6) Facilitate comparisons of supplier quotes: FOB pricing makes it simpler to compare product costs across suppliers since it separates production and shipping costs.

Q2. When is it appropriate to use FOB?

The Free On Board Incoterms is best applied under specific trade conditions, especially when dealing with sea freight. It’s appropriate to use FOB when:

- You deal with international trade via ocean freight.

- You work with your reliable freight forwarder.

- You want more control over shipping.

- You handle bulk cargo or non-containerized shipments.

Q3. What is the opposite of FOB?

In international shipping, the term commonly considered the “opposite” of FOB (Free On Board) is CIF (Cost, Insurance, and Freight).

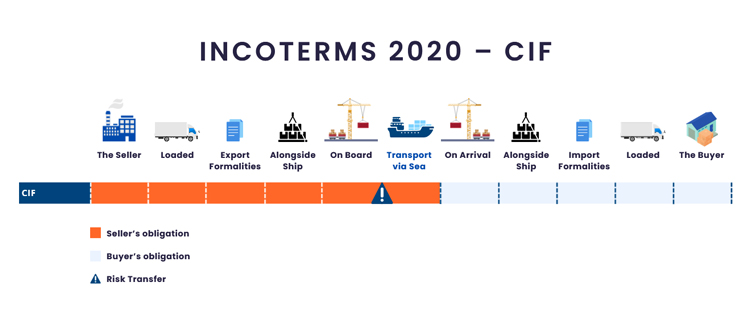

1️⃣ CIF – Cost, Insurance, and Freight

The seller pays for the cost of shipping cargo to the port of export, ocean freight and insurance all the way to the destination port.

Insurance: The buyer only takes over after the goods arrive.

Risk Transfer: Risk transfers from seller to buyer once the goods are loaded onto the vessel at the port of export.

And there are other terms:

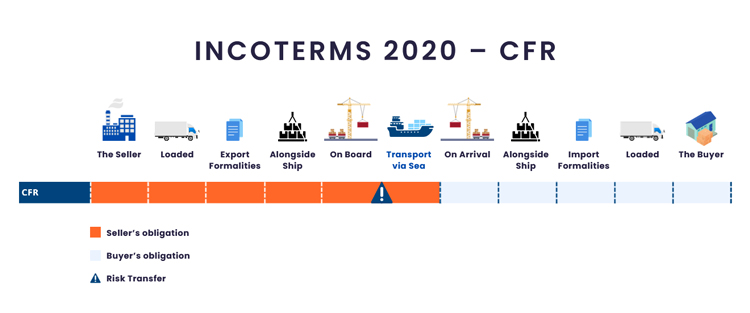

2️⃣ CFR/C&F – Cost and Freight

The seller pays for the cost of goods and the freight to transport them to the destination port.

Insurance: The buyer is responsible for arranging and paying for insurance during transit.

Risk Transfer: Risk transfers from seller to buyer once the goods are loaded onto the vessel at the port of export, even though the seller pays for the freight.

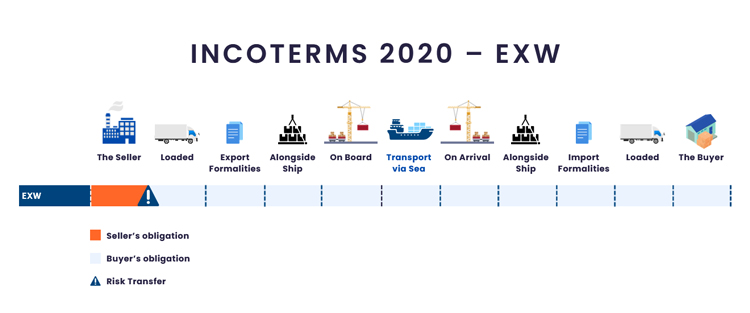

3️⃣ EXW – Ex Works

The seller makes the goods available at their premises (factory, warehouse, etc.). This is the trade term with the least obligation on the seller.

Insurance: The buyer arranges and pays for all transportation, export duties, insurance, and handling from the seller’s door onward.

Risk Transfer: When the seller finishes the production and the goods are available at his location, risk transfers to the buyer.

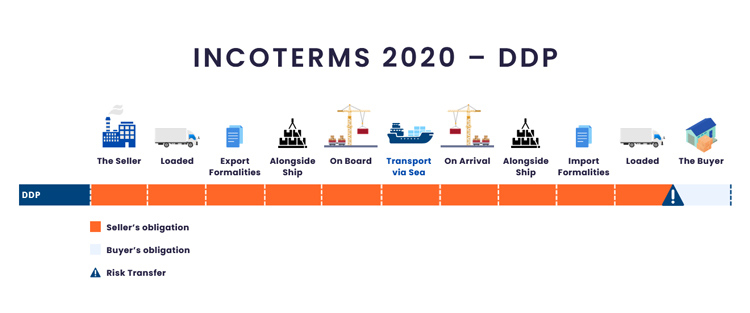

4️⃣ DDP – Delivered Duty Paid

The seller delivers the goods from the export country to the buyer’s designated place (warehouse, store, etc.) within the required delivery time, fully cleared for import.

This includes all transportation costs, export and import duties, customs clearance, taxes, and insurance.

While EXW places the minimum responsibility on the seller, DDP imposes the maximum obligation. It is suitable for all modes of transport.

Insurance: The buyer receives products and pays the purchase price at the final delivery point. Any costs after delivery are the buyer’s responsibility.

Risk Transfer: Risk and cost transfer from seller to buyer only when the goods are delivered, ready for unloading, at the named destination.

Q4. Who pays for port congestion in FOB?

Under FOB Incoterms, if port congestion causes the vessel to wait, incur demurrage, or face scheduling issues, the buyer typically bears those costs. As in the default context, the seller’s responsibility ends once the goods are loaded onto the ship.

However, the responsibility can change if the contract between buyer and seller includes specific terms that shift liability.

So, it’s crucial to clearly define and review the responsibilities in the contract to avoid disputes later on.

Conclusion

Trade terms like FOB are used to determine the delivery method of the goods, and the FOB Incoterm reflects the widely accepted practices in trade. By learning its meaning, liability, costs, and risks for both sides, you can build stronger supplier relationships and manage your shipments more efficiently.

At SVI Global, we strive to ride the wave of globalization and outsourcing. For businesses looking to source from countries like China, Vietnam, Cambodia, Malaysia, etc., we bring our expertise to help you find the right suppliers and secure high-quality products. In addition to sourcing, services in quality control and shipment management are supported.

To survive and thrive in the volatile world, let SVI Global be one of your anchors for growth.